Why Your Average Order Value is Lying to You

Average Order Value (AOV) is one of the most popular metrics in eCommerce. It’s plastered across dashboards, referenced in strategy meetings, and utilsed for key business decisions. But you need to be careful, AOV is misleading you.

AOV is Just a Middle Point, Not the Full Picture

Most brands assume that their customers place orders somewhere around their AOV. That’s logical, right? If your AOV is £75, you’d expect a large share of customers to be ordering close to that amount.

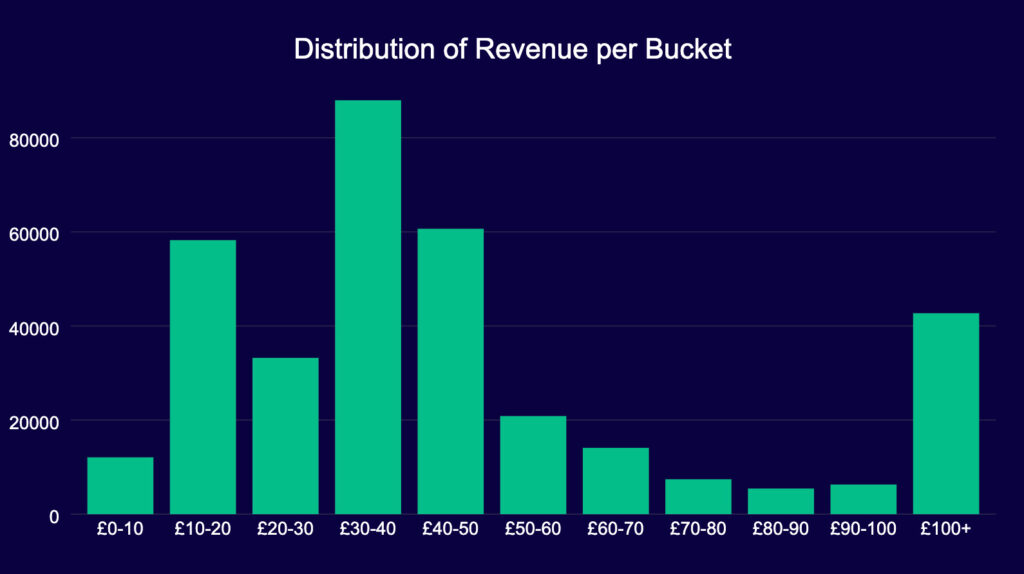

But when you actually visualise order value distribution, you quickly see a different story:

- A huge volume of orders sit below the AOV

- Another set of high-value transactions sit well above it

- AOV? It’s simply the midpoint and not a true reflection of where orders actually fall

Instead of being a reliable benchmark, AOV often distorts reality.

AOV is Driving Flawed Strategies

Because AOV is widely accepted as a guiding metric, businesses frequently use it to set key pricing tactics most notably, the free shipping threshold.

For example, if your AOV is £75, you might decide to set your free shipping threshold at £80, assuming it nudges customers to increase their cart size. But here’s the catch: if the majority of your orders are actually around £40-£50, your threshold is completely misaligned.

This means:

✅ You’re missing an opportunity to encourage more incremental increases.

✅ You’re setting a target that many customers simply won’t stretch to reach.

✅ You’re potentially losing out on conversions from customers who see the free shipping threshold as too far out of reach.

Instead of setting free shipping based on AOV, businesses should be looking at the most common order value ranges and adjusting their pricing strategies accordingly.

Breaking AOV into Order Value Buckets

To truly understand your customers’ purchasing behaviour, bucket your orders into meaningful value ranges.

For example, instead of relying on a single AOV number, look at:

- Orders under £xx (low-value, high-frequency purchases)

- Orders between £xx-£xx (mid-tier, balanced buyers)

- Orders above £xx (higher-end, big spenders)

By doing this, you can make more data-driven decisions when it comes to pricing strategies, upsells, and incentives. You might find that:

- Most of your volume sits around £45, meaning a free shipping threshold of £50 makes far more sense than £80.

- Customers in the mid-tier range respond well to bundling incentives.

- High spenders have different behaviours entirely and should be treated as such.

We also recommend visualising ‘revenue’ per bucket, as this can tell a completely different story to ‘order count’. You might be surprised how much revenue comes from your higher-end big spenders.

The Bottom Line

AOV alone is not enough to guide strategy. Without understanding the actual distribution of orders, businesses risk miscalculating incentives, pricing, and marketing efforts.

If you haven’t broken down your AOV into order buckets yet, now is the time to do it. The insights you uncover could completely change how you drive more revenue from your customers.

Want help to visualise your order value distribution? Let’s chat. 🚀